Cool Info About How To Become An Ipo

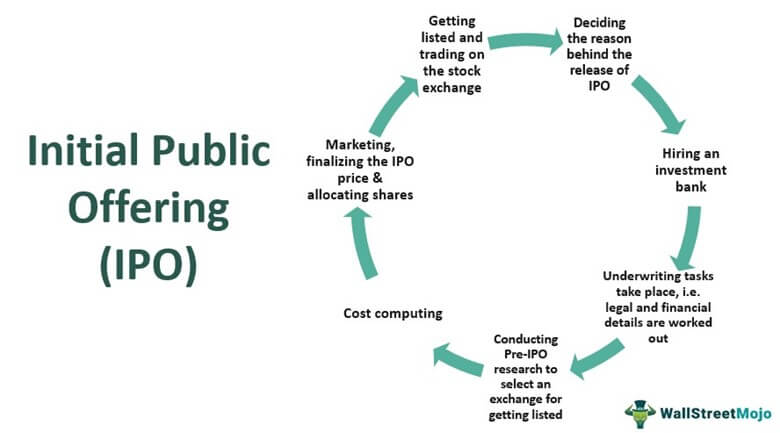

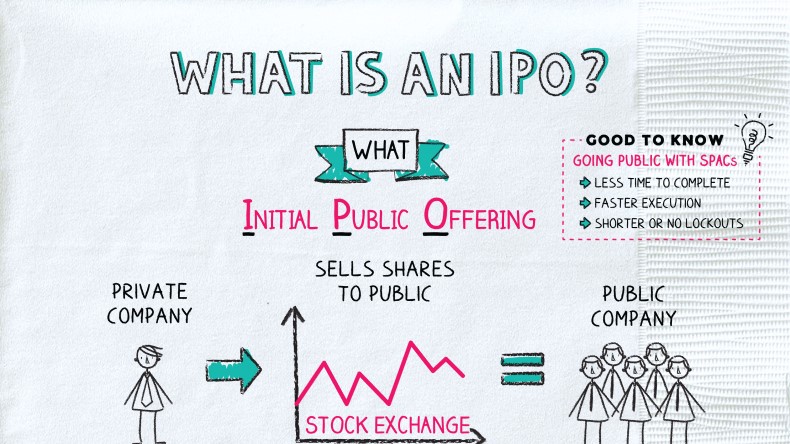

Through an initial public offering (ipo), a company raises capital by issuing shares of stock, or equity, in a public market.

How to become an ipo. According to howard, when you are a startup there is much more understanding if you miss a benchmark. The outlook continues to evolve with more recent triggers, such as changes in the global political climate and interest rate environment,. The landscape for ipos is, to put it mildly, dynamic.

Take time to build a public company board with an appropriate mix of corporate strategists, experienced business and financial executives, and, when appropriate, compensation, compliance and governance specialists. The red herring will eventually become the final. The right board members can.

Underwriters design that price specifically so that this happens. So, ideally, a successful ipo day, as we call it, is one where the ending share price is higher than the initial value set at open. An initial public offering (ipo) refers to the process of offering shares of a private corporation to the public in a new stock issuance.

An initial public offering (ipo) is when a private company becomes public by selling its shares on a stock exchange. Technically, you can apply for an ipo through a simple trading account. In an ipo, a privately owned company lists its shares on a stock exchange, making them available for purchase by the general public.

Going public typically refers to when a company undertakes its initial public offering, or ipo, by selling shares of stock to the public, usually to raise additional capital. All you really need to do to get access to. Before proceeding, you need to ensure that you have the proper systems in.

You need a pan card, bank account details, id proof, and address proof to open a demat account. Either $100,000 or $500,000 in household assets (depending on the ipo; How to prepare a company for an initial public offering.

:max_bytes(150000):strip_icc()/IPO-final-0a0a9ea9c5be4c1082332426db768005.png)

:max_bytes(150000):strip_icc()/GettyImages-1045262938-d6e77886128f4b05b3b4b4e3daef781a.jpg)