Painstaking Lessons Of Info About How To Keep Good Credit

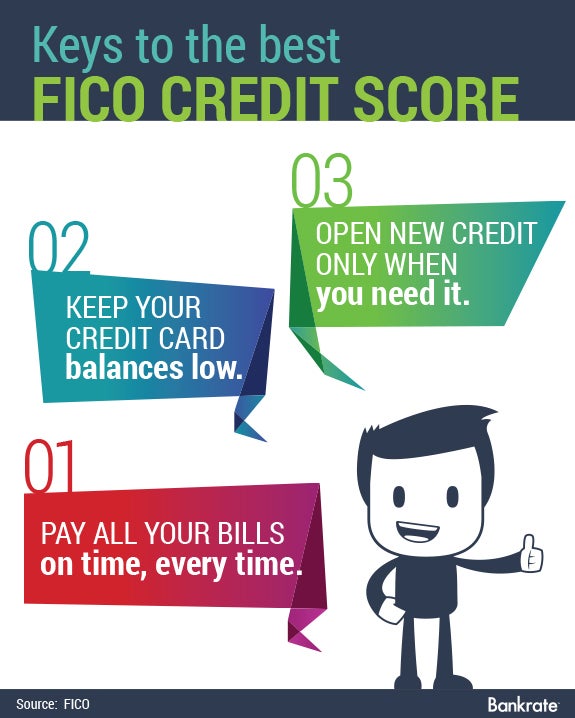

Paying off your revolving loans every month is a good financial habit that has a positive effect on your credit score.

How to keep good credit. Ad responsible card use may help you build up fair or average credit. Pay your bills on time. Keep track of your debit and credit card transactions, atm card usage and any checks you've.

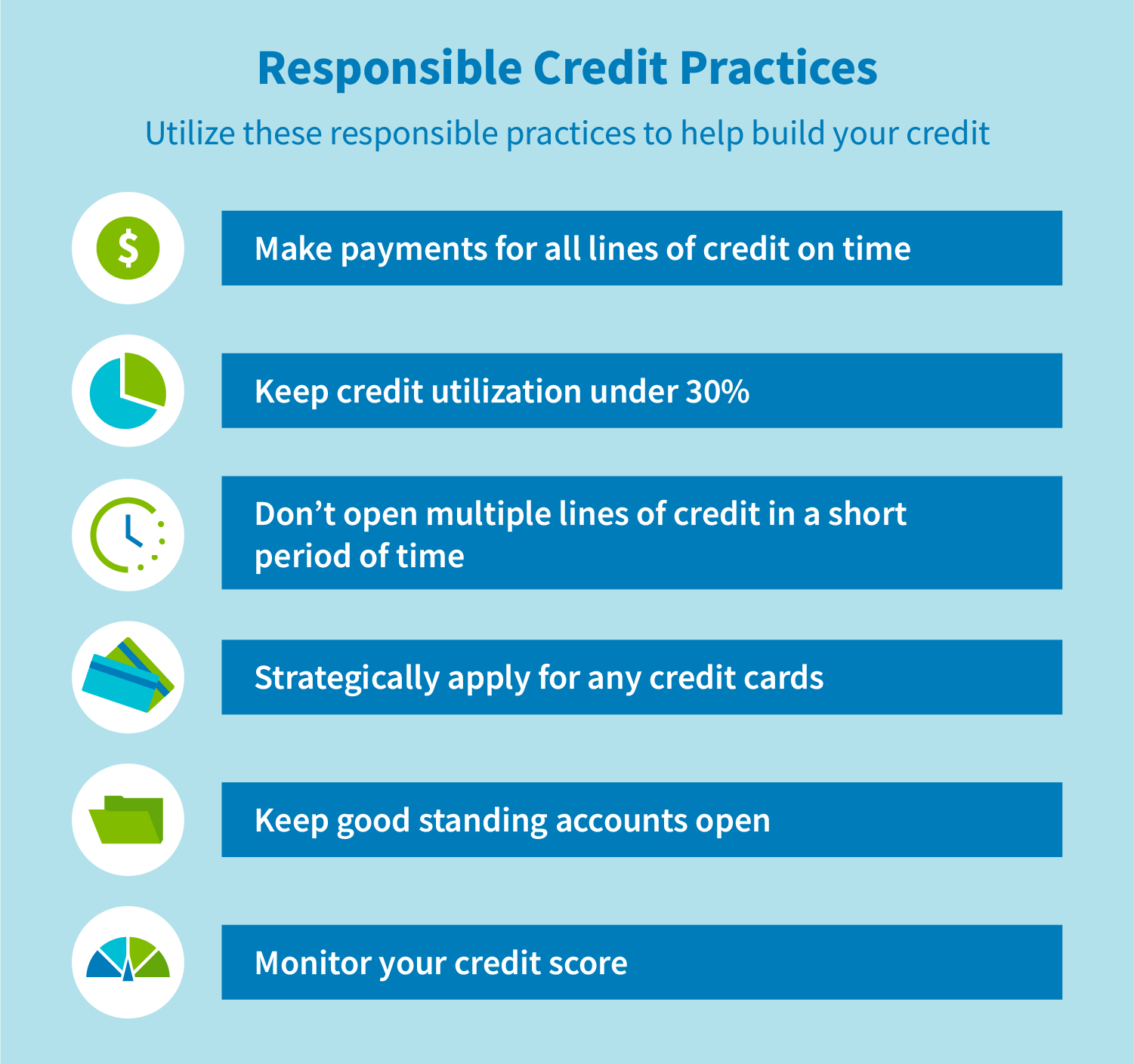

As a last resort, if you can’t seem to get a handle on your credit card debt, it might be worth looking into debt consolidation or speaking with a credit counsellor. Treat all of your debts equally when it comes time to pay. According to the federal citizen information center (fcic), there are several ways you can maintain a good credit history:

As a rule of thumb, always try to keep it. The optimal credit utilization rate is 1%, “which is actually kind of silly to target,” financial expert john ulzheimer, formerly of fico and equifax, tells cnbc select. Therefore, the next important step to take to improve your.

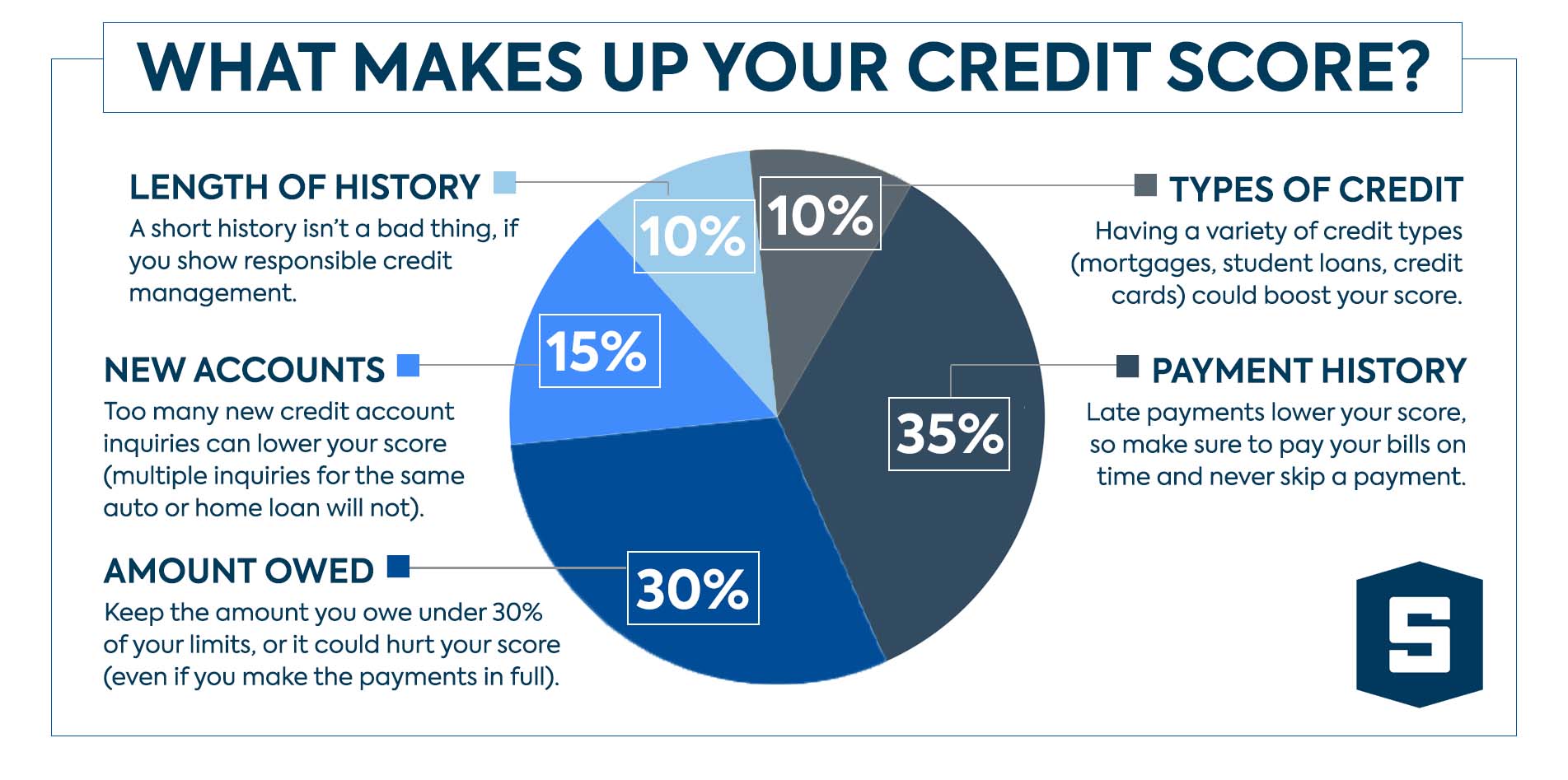

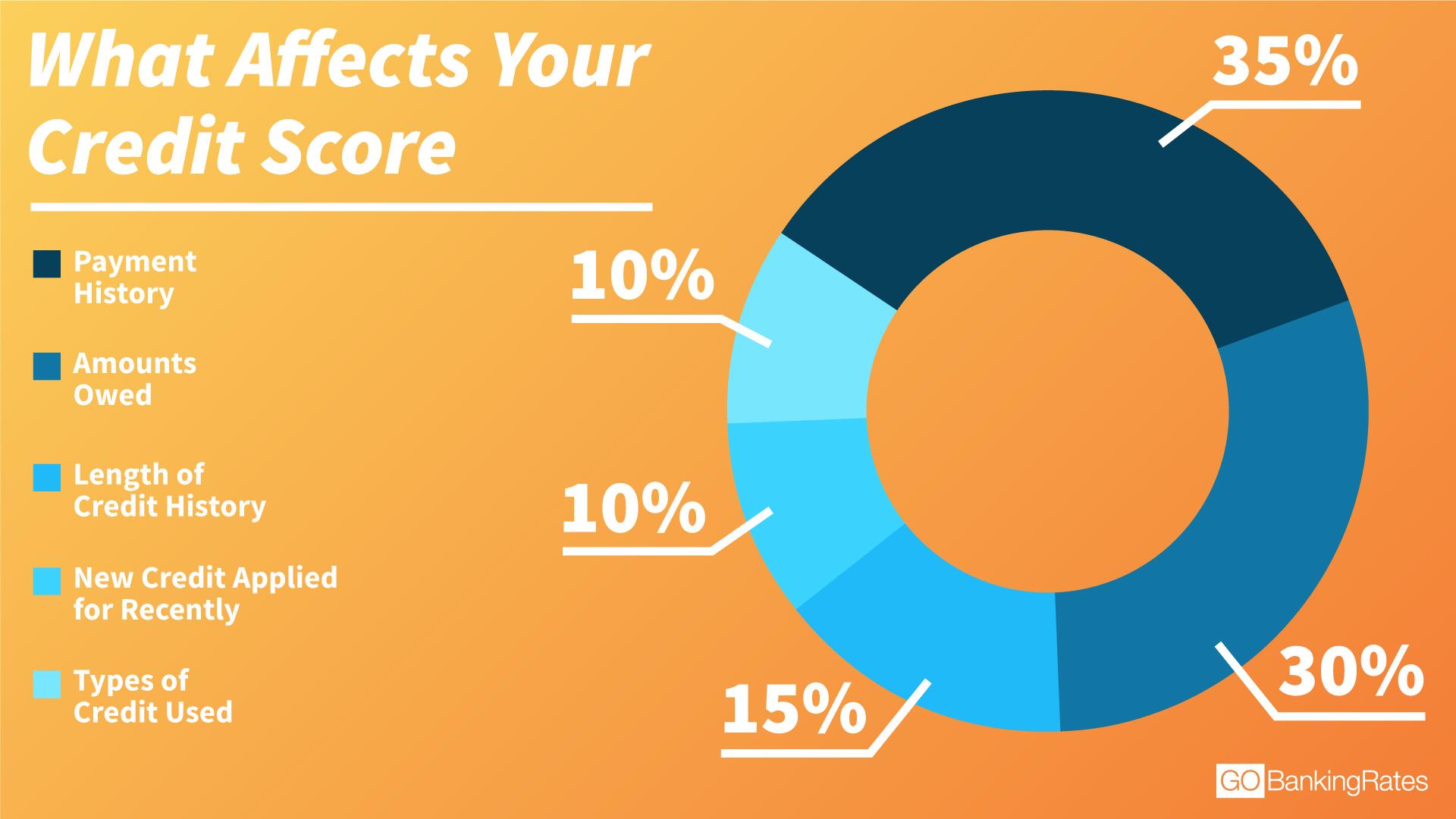

Credit utilization is the next largest factor, making up 30% of your overall credit score. Keep track of your spending: This habit lets future lenders and creditors know you're a responsible borrower.

Find a card with features you want. Credit cards offer one of the best ways for you to build your credit and improve your credit scores by showing how you manage credit on a regular basis. Improve your credit by up to 60 points.

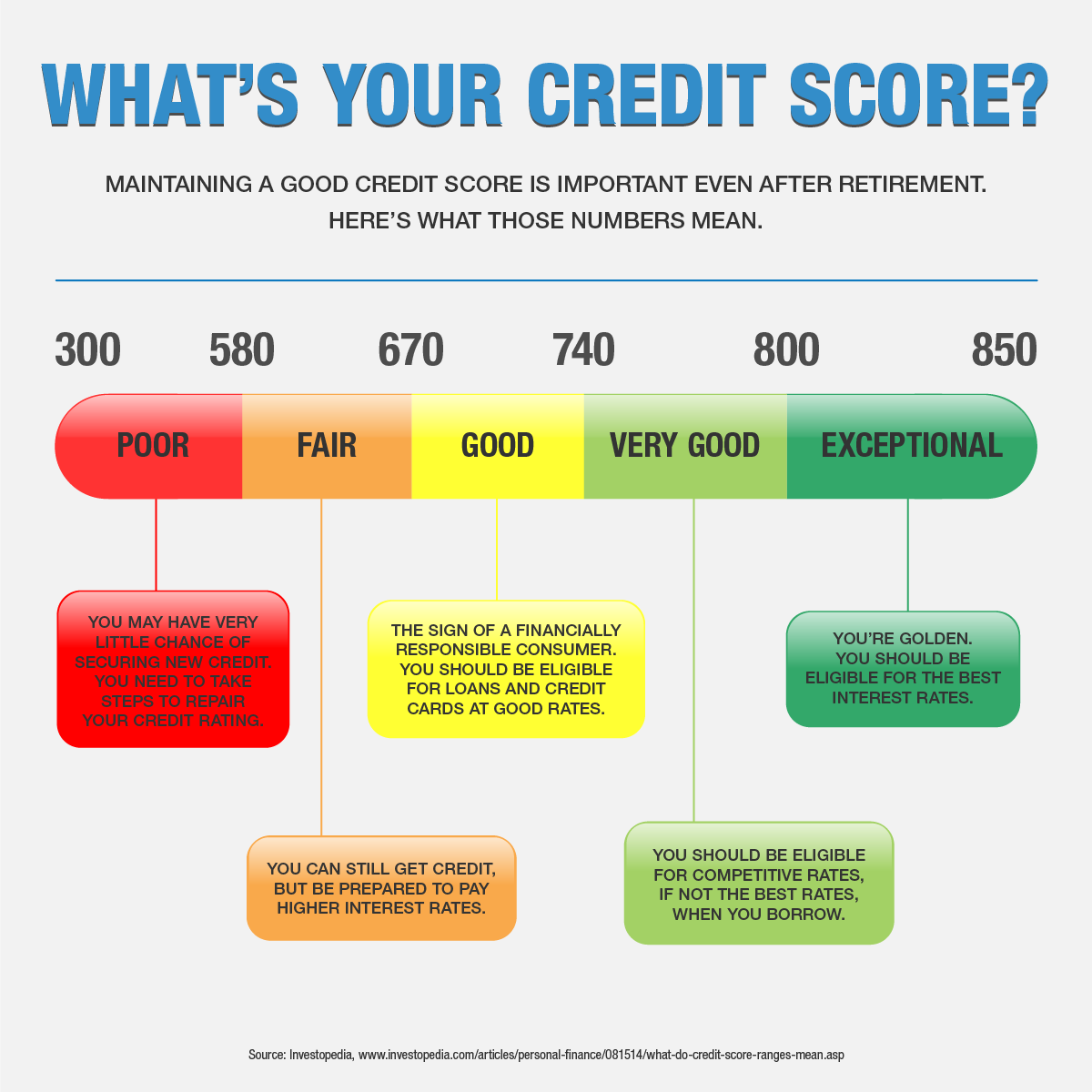

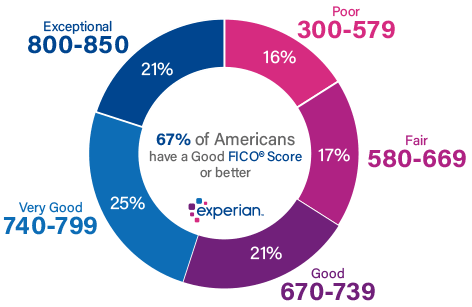

Maintain a good credit score by understanding the scoring factors, automating your bills, keeping debt in check and regularly monitoring your credit. The best way to build good credit is to create the habit of charging only what you can afford. Don’t borrow more than you can afford to repay in a reasonable length of time.

/things-that-boost-credit-score-960381-v2-9599c06fcdfd4108b67a291dabd43b7d.gif)